Future Market Trends for Foldable PV Containers

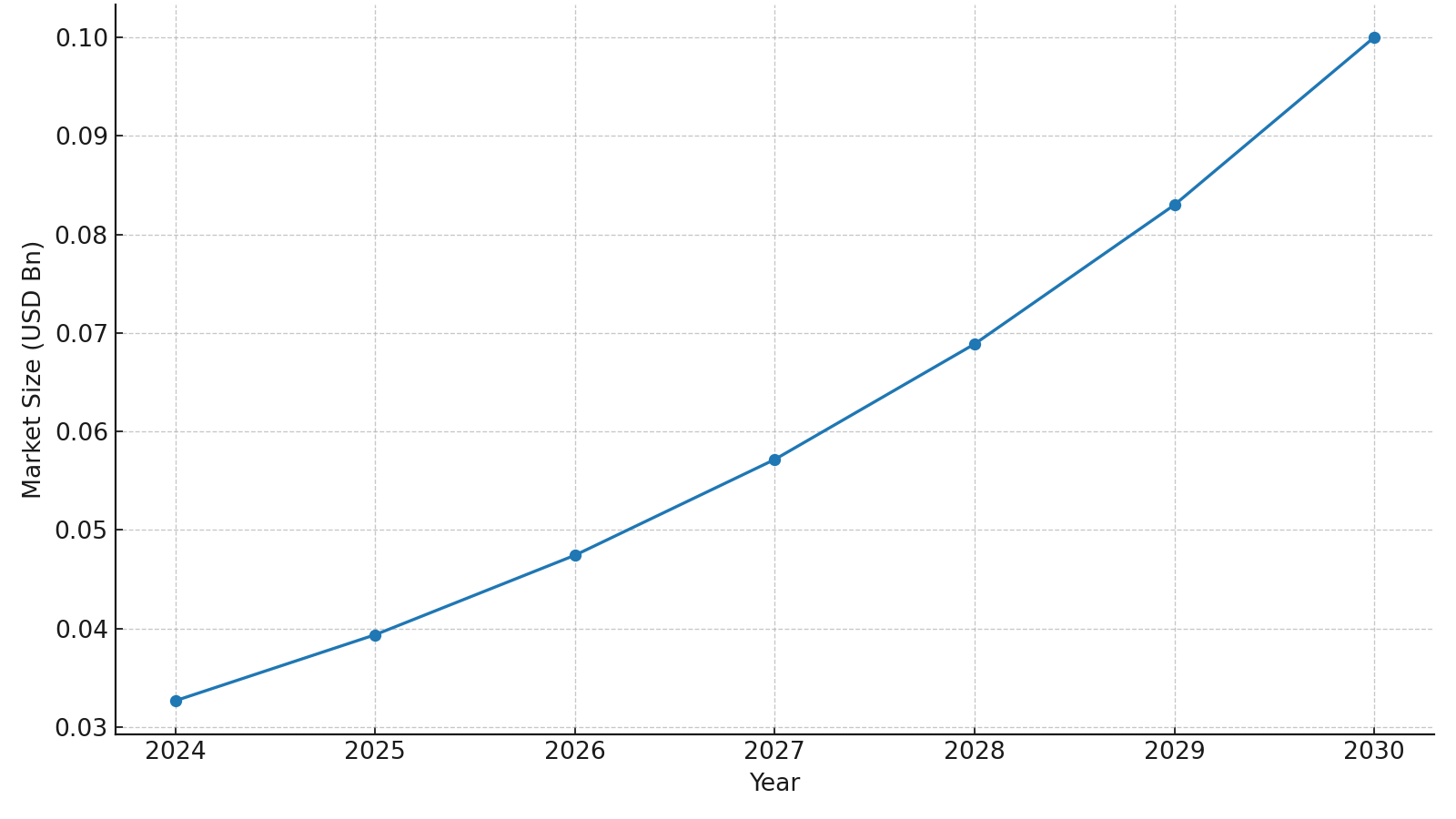

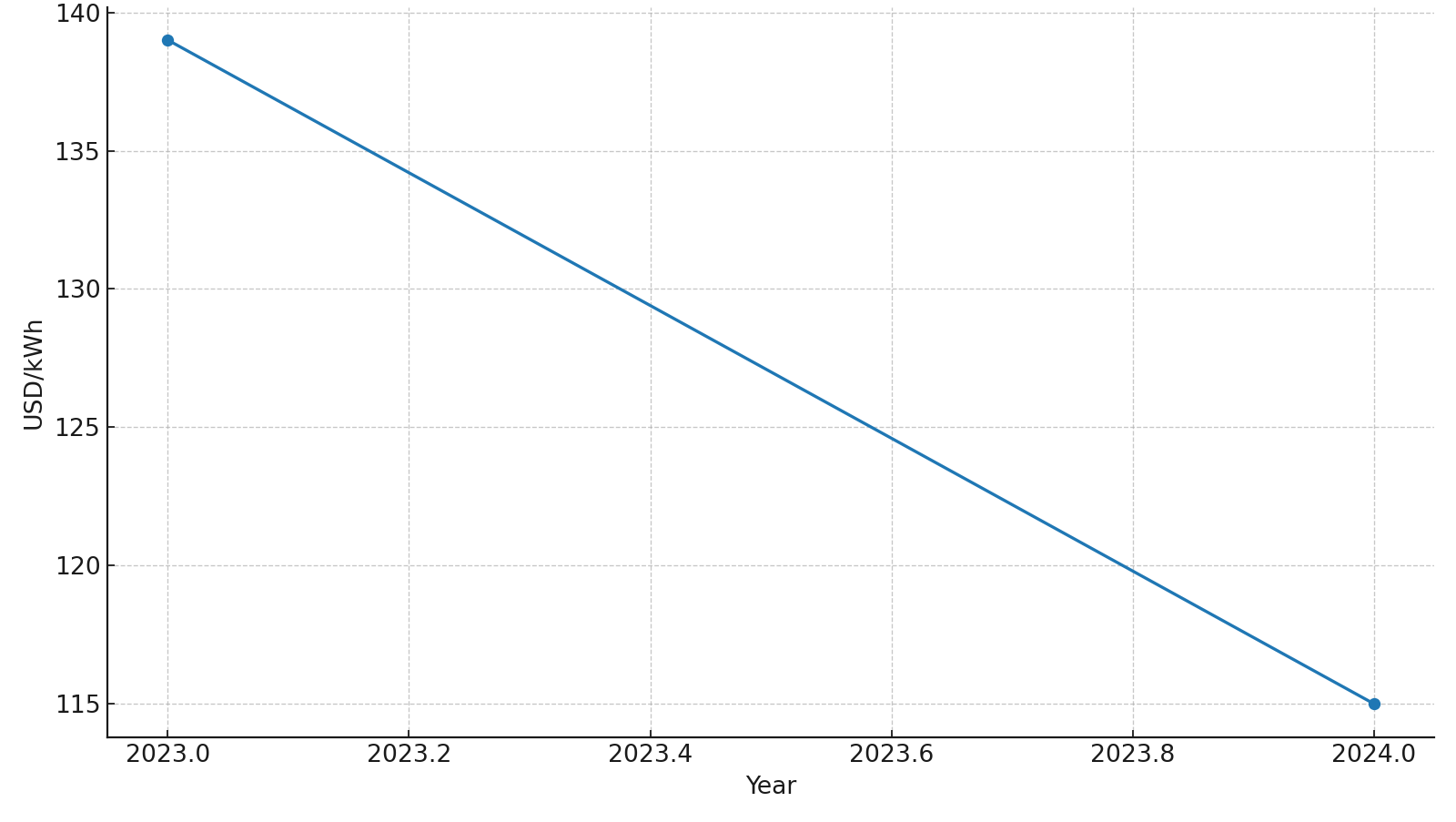

Foldable PV Containers are gaining traction in high-growth niche markets such as industrial temporary power, mining campsites, events, and military applications, thanks to their compact transport size, rapid on-site deployment, and built-in inverter/energy storage capabilities, enabling plug-and-play functionality. While market forecasts from various institutions may differ in methodology, they all point to a “rapid growth” conclusion: the “foldable” segment is projected to reach approximately $100 million by 2030, with a CAGR of around 20.5%; When expanded to the broader category of “solar containers/container-based photovoltaic power systems,” most estimates project annual compound growth rates of 12%–20%+, with market sizes in the tens of billions of dollars by 2030–2034. On the cost side, lithium-ion battery system prices are projected to drop to 115 USD/kWh (-20%) by 2024, while component prices continue to decline, further enhancing commercial viability.

- Market Status and Scale Criteria

Foldable PV “Narrow-Mouth” (Including folding and unfolding mechanisms)

QYResearch estimates: approximately USD 100 million by 2030, with a CAGR of 20.5% (2024–2030). This category primarily covers complete systems with folding mechanisms that can be quickly deployed.

Solar Container “Broad Definition” (Including non-folding, integrated enclosures with energy storage/inverters)

Multiple institutions project CAGRs ranging from 12% to over 20%, with endpoint market sizes ranging from approximately $850 million (2030) to $25.51 billion (2034). The discrepancies stem from whether higher-power segments are included and whether “utility-scale” mobile power sources are accounted for.

Figure 1 | Foldable photovoltaic container market forecast (data based on QYResearch: $100 million by 2030, CAGR 20.5%)

Figure 2 | Rapid decline in lithium-ion battery system prices (data source: BNEF)

Summary of multi-institution forecasts for the relevant market segments (CAGR and market size)

| Segment | Source | Years | CAGR_% | End_Size_USD_Bn |

| Foldable PV panel container (niche) | QYResearch via FindIt | 2024–2030 | 20.5 | 0.1 |

| Solar container (broad) | MRFR 2025–2034 | 2025–2034 | 19.38 | 25.51 |

| Solar container (broad) | TechSci 2024–2030 | 2024–2030 | 20.49 | 17.26 |

| Containerized solar generators | Dataintelo 2023–2032 | 2023–2032 | 12.5 | 3.5 |

| Solar container power systems | MarketReportAnalytics 2024–2030 | 2024–2030 | 12 | 8.5 |

- Three Hard Evidence Points for Growth

- The “downward trend” in costs has been confirmed.

Photovoltaic modules: Starting in 2023, global overcapacity and high inventory levels will lead to a significant decline in prices, with further decreases expected in 2024.

Energy storage batteries: BNEF data indicates that battery packs will reach a historical low of $115/kWh in 2024. The overall BOM reduction of the “PV+storage+inverter+EMS” system is the key underlying factor driving the cost-effectiveness of foldable containers.

- Expanding Demand Side

Emergency/Disaster Relief and Off-Grid Applications: Containerized, rapidly deployable power generation and energy storage units are replacing diesel generators, offering environmental benefits, low maintenance costs, and quiet operation. These solutions are rapidly penetrating public safety, military and police logistics, mining campsites, research stations, and sporting events.

Global expansion of clean energy investment: The IEA forecasts that clean energy investment will reach $2 trillion in 2024, with approximately $500 billion allocated to photovoltaic investment. Cost reductions and capacity expansions in the upstream supply chain will continue to benefit mobile and modular product forms.

- Product Capability Enhancement and Standardization

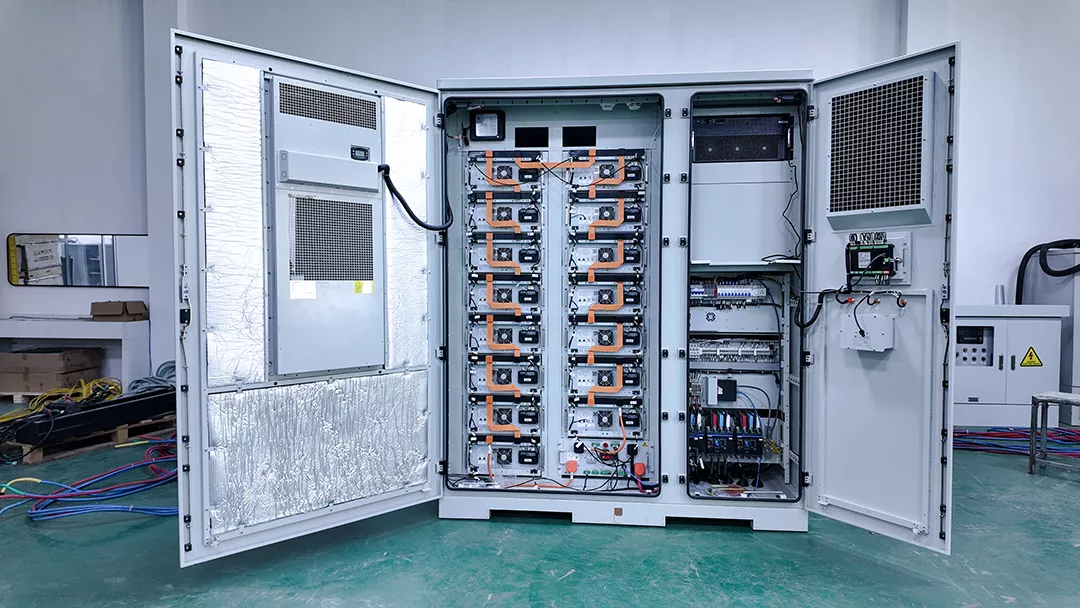

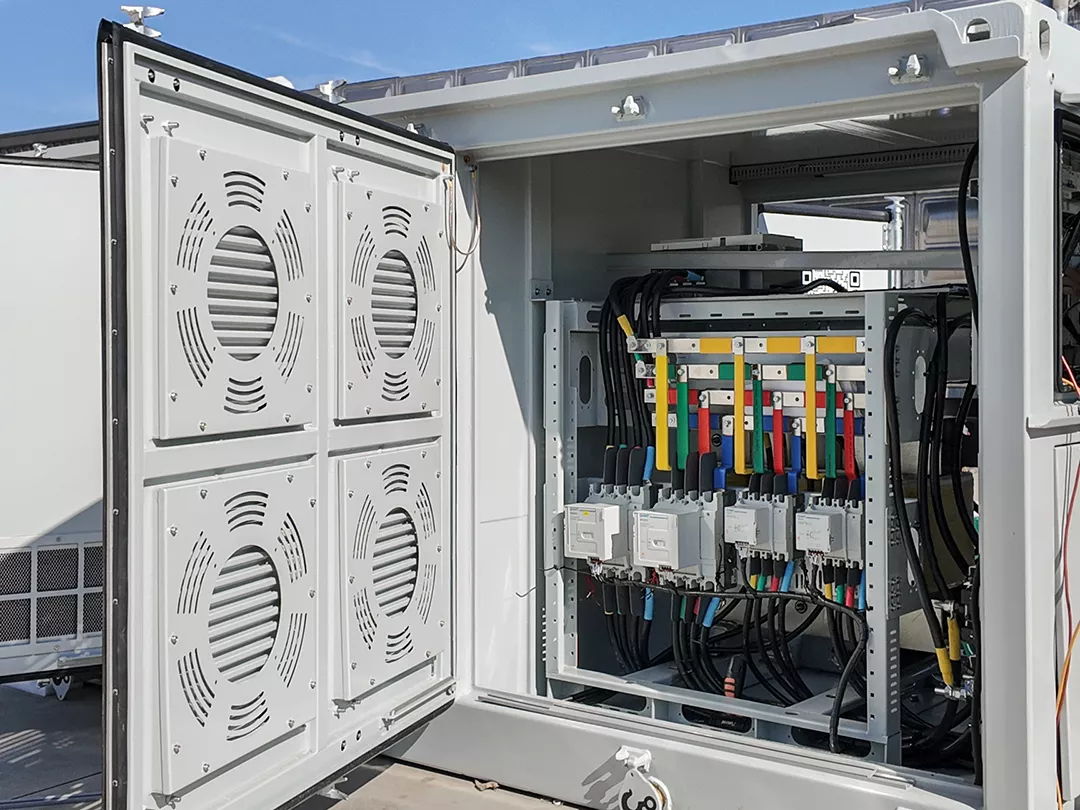

Modular capabilities such as folding and unfolding, quick wiring, and EMS remote monitoring are continuously iterated, transitioning from “engineering products” to “industrial standard components,” further optimizing delivery cycles and lifecycle costs.

III. From “Temporary Power Supply” to “Mobile Microgrid”

Government and Humanitarian Aid: Zero-carbon temporary power supply and medical/communication support in post-disaster reconstruction and areas with temporary power shortages.

Industrial/Construction Sites: Replacing diesel generators to reduce fuel logistics, noise, and emissions; when paired with energy storage, enabling peak shaving and nighttime lighting.

Mining/Camps/Military: High mobility and low reliance on supplies, reducing the levelized cost of energy (LCOE) over the entire lifecycle.

Commercial and Events: Rapid deployment and recovery for events, performances, and exhibitions, meeting ESG and carbon footprint requirements.

- Fragmented Landscape, Opportunities in “Productization + Serviceization”

There are numerous global participants in containerized photovoltaic/energy storage, with the market moderately fragmented: there are both innovative companies focused on containerized energy and integrated manufacturers extending downstream from components, inverters, and BESS. —This means that regional partner networks, delivery speed, services, and leasing models will become key differentiators.

- Risks and Hedging

Differences in measurement criteria lead to scattered scale expectations: folding structures vs. broad containerization, whether to include high-power and leasing inventories, etc., must be clearly defined in the business plan.

Upstream price fluctuations: Silver prices, silicon material, and freight costs remain volatile; however, the overall trend still leans toward “long-term cost reduction.”

Grid connection/disconnection switching and certification: Different countries have varying requirements for mobile power grid connection and safety standards; testing, certification, and grid connection design must be completed in advance in the exporting country. VI. Recommendations

- Recommendations for Manufacturers/Channels/Owners

- Dual-wheel product line:

The “Foldable Rapid Deployment” model is designed for high-response scenarios such as rescue operations, events, and mining camps;

The “Standard Container + Energy Storage” model is designed for industrial temporary power supply/leasing, emphasizing reliability and TCO.

- Leasing instead of sales and Energy Performance Contracting (EMC): Reduce customers’ one-time CapEx and accelerate market penetration.

- Platform-based EMS and Remote Maintenance: Align with diesel generator rental “fleet management” models to achieve equipment assetization and datafication.

- Certification First: Ensure grid connection, fire safety, and electrical safety standards are met in target markets from the outset to guarantee delivery speed.

- Supply Chain Diversification: Establish dual supply chains for critical components (modules, inverters, BESS) to hedge against cyclical fluctuations.

+86 18721624519

+86 18721624519